Industry news archive

Before the start of the new heating season, when the load on power plants and heating plants is sharply increasing, power engineers again reminded about the reliability of the unified electric power system of the Republic of Kazakhstan - they are concerned about a possible shortage of available capacity.

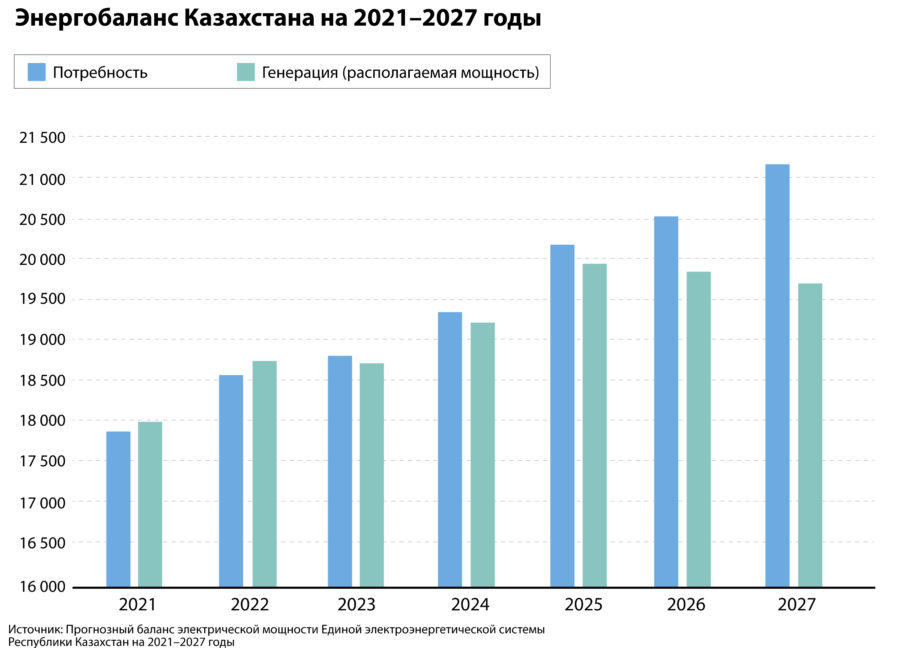

The projected energy balance for 2021–2027 shows that in 2023 Kazakhstan will have a 63 MW deficit of available capacity. The volume of available capacity by that time will amount to 18,800 MW instead of the required 18,863 MW. This difference will increase and by 2027 will approach 1,500 MW.

Power engineers have been focusing on this recently. In a report on the results of the first half of 2021, the national company Samruk-Energo, which generates 31% of the country's electricity, noted a “rapid decline in available capacity reserves” amid growing consumption (on average 4% for 2017-2020, or by 600 MW annually), referring to the “brewing power shortage in the industry”.

The projected electrical balance does not show a deficit in 2021. However, according to the data of the system operator KEGOC, last winter the actual reserve of the Unified Electric Power System (UES) of the Republic of Kazakhstan in relation to the operating capacity decreased to 600 MW. “Industry experts fear that if the current rates are maintained in the next heating period, there will be no power reserves in the UES of the Republic of Kazakhstan, which is fraught with restrictions in power supply,” the message from Samruk-Energo says.

Despite the shortage of available capacity, electricity production in the country will grow in the future. According to the electric balance in 2023, generation in Kazakhstan will outstrip consumption by 7.9%. The paradox is explained by the peculiarities of the power system: power plants must have a capacity that covers the maximum possible daily consumption.

The regulator keeps your finger on the pulse

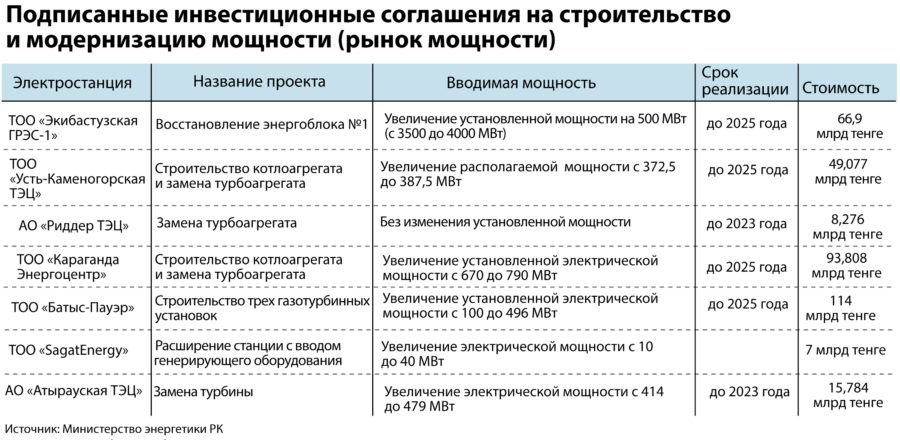

In order to prevent a shortage of available capacity, the regulator (Ministry of Energy) plans in advance the reconstruction or commissioning of new power units. For this, in 2019, a capacity market was launched in Kazakhstan - a special tariff for energy producing organizations (EPO), which is paid to return their investments in the construction of capacities and modernization. As of August 2021, the Ministry of Energy signed eight investment agreements with EPO. The first project on the new mechanism was completed in 2020 (the hydropower units of the Shardarinskaya HPP with 63 MW were updated). The remaining seven agreements will allow by 2025 to renew 80 MW, restore 500 MW and introduce new 540 MW of electric power. Six more projects are pending.

“Together, by 2025, this will give us 1,584 MW (seven approved and six projects under consideration). We have a vision of how we will cover the deficit. We are working according to this plan, ”says Aydos Daribayev, director of the Department for the Development of the Electricity Industry of the Ministry of Energy.

He clarifies that some of the investment agreements have not yet been reflected in the forecast balance sheet. Thus, if in 2025 the deficit of available capacity is 226 MW, then the volume of the new one will exceed it several times. Taking into account the capacities that will be retired, this will help to achieve a balance in the energy market.

A nuclear power plant could solve the problem of basic capacity shortage, recalls Zhakyp Khayrushev, an expert in the field of electric power and author of the Haırýshev energy Telegram channel.

“We need one large base power plant, and it must be nuclear, in the center of Kazakhstan. It is necessary to build power lines from it - to connect the western part with the north and strengthen the lines in the west. Then we will probably forget about problems with reliability and scarcity. It should be very large, from 1500 MW to 2000–3000 MW, ”the expert explains.

However, the issue of building a nuclear power plant in Kazakhstan is primarily on the political plane and requires the preparation of public opinion.

The choice of nuclear generation can be justified from a financial point of view: it will be easier to find funds for the construction of a nuclear power plant (for example, for the construction of the BelNPP - the Rosatom project - the government of Belarus received a loan from VEB) than for a new coal capacity. The specialists interviewed by Kursiv, who deal with the climate agenda in the energy sector, note that development banks and commercial institutions no longer finance the construction of coal facilities.

According to Daribayev, the more acute issue is the shortage of flexible generation, which in 2021 is about 500 MW. In the last five years, according to the system operator, deviations of production and consumption from the planned values can reach up to 1 GW. Maneuverable power almost instantly begins to supply electricity to consumers during peak hours or during emergency outages (within 15 minutes after switching on). A traditional coal-fired plant takes up to 24 hours to warm up a boiler from a cold state. The situation is complicated by the old power transmission infrastructure and the growing share of renewable sources (up to 15% of the total generation in Kazakhstan by 2030), whose generation is unstable.

To solve the problem, in December 2021, the first auctions will be held for the construction of a flexible capacity of 1000 MW in different regions of the country. The emphasis will be placed on gas power, which is a maneuverable type of generation. This, as the director of the profile department emphasizes, will partially cover the expected shortage of available capacity.

Looking for a fare

Since the capacity market is the main mechanism for investing in generating assets, the key link in the scheme, from the point of view of investors, is the value of the capacity tariff. Recalling the shortage of available capacity, power engineers ultimately convey the following idea to the regulator: the capacity tariff must satisfy the investor's appetites and cannot be unilaterally adjusted downward.

The government of the Republic of Kazakhstan adheres to a social agenda and cannot allow the growth of tariffs to lead to an increase in the cost of living for the population. According to Khairushev, in the initial concept, the fair capacity tariff was 750 thousand tenge / MW per month, in 2021 it was approved at 692.4 tenge / MW per month, excluding VAT.

“Today the tariff is a social instrument, which is approved taking into account the specifics of the entire economy. The restoration of "hardware" and the supply of modern equipment is a secondary matter, "says the interlocutor of" Kursiva ".

One of the first large investment projects implemented within the capacity market will be the commissioning of power unit No. 1 at the Ekibastuz GRES-1 with a capacity of 540 MW by the end of 2023. Khayrushev assumes that the project was implemented "to a greater extent" at the expense of Samruk-Energo's own funds.

“When we calculated the tariff in the concept (of the capacity market. - Italic), the dollar did not cost 425 tenge. In addition, since the beginning of 2021, all manufacturers of power equipment, and these are mainly the Russian Federation, China and Europe, reported that they are raising prices by 20-30%, ”the expert added.

Uncertainty around capacity tariffs calls into question the implementation of the projects planned by power engineers. The most detailed information about its plans is provided by Samruk-Energo, which intends to implement five investment projects by 2026, three of them within the capacity market. This is the construction of the third power unit at the Ekibastuz GRES-2 with a capacity of 636 MW, the reconstruction of the Almaty CHP-1 of the AlES with an increase in capacity to 250 MW and the modernization of the Almaty CHP-2.

“For the third power unit of the Ekibastuz GRES-2, we received a positive recommendation from the Council for the Electricity and Power Market and are at the stage of discussing an investment agreement with the Ministry of Energy. Currently, a feasibility study is underway for CHPP-1 and 2. These projects are planned to be implemented from 2021 to 2025, "said Ansar Aydarov, head of the Project Portfolio Management Office of Samruk-Energy.